Learn how you can set up direct deposit without a voided check. Speaking with your payroll department and finding other options through your bank could mean an easier time getting direct deposit to your checking or savings account without a hitch.

Direct deposit is a useful payroll feature that lets you get your paycheck deposited directly into your checking account. Instead of getting a physical check each payday, the money shows up in your account the morning that your paycheck is due. This saves you the hassle of having to visit the bank to cash your paycheck multiple times a month. Often, when you try to set up direct deposit, your employer will ask for a voided check. They use the check when setting up your direct deposit. Learn why your employer requests a voided check and find out what alternatives you can provide to your payroll department.

Employers ask for a voided check when setting up your direct deposit because it provides all the information necessary to deposit money in your checking account. All U.S. banks have routing numbers and all deposit accounts have account numbers attached to them. Routing numbers are used to identify financial institutions and have been in use for a century. A routing number indicates a specific financial institution, as well as the geographic region of the country it is located in. No two different banks can have the same routing number. Account numbers identify specific accounts at a financial institution. No two accounts at the same bank will have the same account number. It is possible for different banks to assign the same account number to different accounts. Because the banks have different routing numbers, your payroll department won’t have trouble sending your paycheck to the right place.

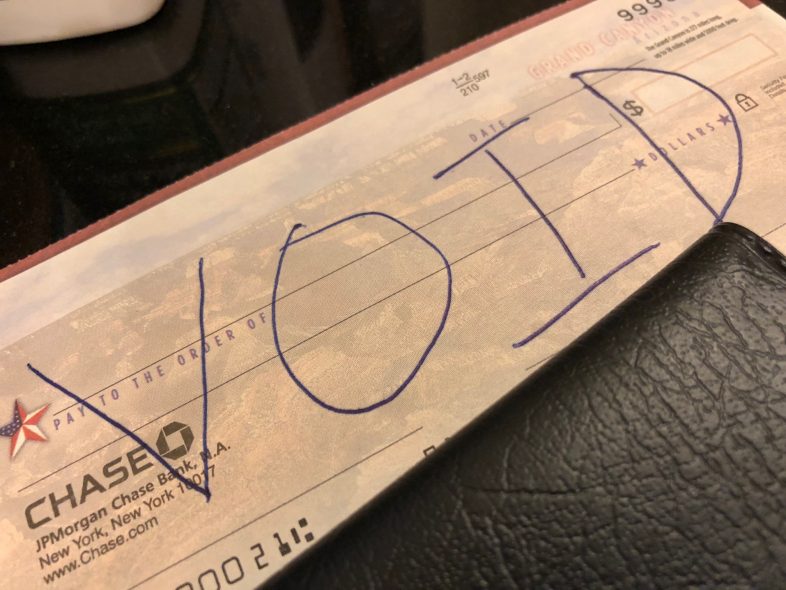

Your employer can identify your specific bank account using just the routing number and account number you provide. The payroll system will use the bank’s routing number to direct your paycheck to the proper bank. It will provide your account number so the bank can deposit the money into your account. In theory, you should be able to just provide a routing number and account number to your payroll department. The voided check isn’t necessary, it just happens to have both numbers printed on it. So long as they copy that information properly, they’ll be able to make the deposit. Still, many companies require that you provide a voided check. Your company will place the voided check in your file so that it can be referenced in the future if necessary. For example, if your company changes payroll processors, it may need to provide everyone’s routing and account numbers to the new processor. Having the voided check on-hand also reduces the likelihood of payroll using the wrong information when it sends out paychecks since they have the check on-hand to reference.

It’s very important that the payroll department send your paycheck to the proper place. If it winds up in the wrong account, it can be a huge headache to get the money back. If this happens, the first thing to do is to notify your payroll department. You’ll have to prove that the money never arrived. Usually, you can just provide a statement that shows the lack of a deposit. Then, your payroll department will need to track where the money was sent. Then, it will contact the bank that received the erroneous deposit and request that the money be returned. Finally, once the money is returned, your company will send it to you. This process can take weeks or even months. That’s why many employers are strict about requiring a voided check. If you do not want to provide a voided check, you can ask your employer for alternate ways to confirm a bank account. You could also ask your employer to make an exception for you if you have specific reasons for not providing the check.

By clearly writing "VOID" on the check in multiple places, you make it impossible for someone else to use. You can then provide the check to your employer so they can set up direct deposit.

If you don’t have a checkbook, or don’t want to void one of your checks, contact your bank. A teller may be able to print a pre-voided check that you can use to confirm your account. Most banks that operate physical branches will be happy to do this for you.

If for whatever reason, you cannot or do not want to provide a voided check, you still have options.

Many banks, even if they don’t provide pre-voided checks, offer direct deposit forms. These forms are like pre-filled direct deposit forms that you can provide to your employer. They should suffice as proof of your checking account for your company.

Another option is to ask a teller at your bank for documentation that provides the same information as a voided check. A letter on bank letterhead with your account information could work. All you really need to provide is your account number and the bank’s routing information.

In a pinch, you might be able to provide a copy of a recent account statement. It will include your account number and the name of your bank. You can provide the routing number to your employer who can check it to confirm that it matches the name of the bank on the statement.

It’s worth taking the necessary steps to set up direct deposit because it can save you a lot of time. Another benefit is that many banks charge maintenance fees that can be waived if you set up direct deposit. Setting it up can mean you save a few dollars every month by avoiding bank fees.

If you want to get fancy with your money management, or just automate it further, you can split your direct deposits. That means that you can have a portion of your paycheck sent to different accounts.

For example, say that your usual paycheck is for $1,200, but you only spend $1,000 per pay period. You can set up your direct deposit to put $1,000 of your check into your checking account.

Then, you can send the remaining $200 to your savings account. You don’t have to think about the extra money or manually move it to the account.

It just automatically arrives in your savings account and starts earning interest. (We always recommend an online savings account with high interest rates and low fees.)

Unlock exclusive savings rates and gain access to top-tier banking benefits.